Islamic fintech Wahed Inc is expected to take its valuation to around $300m as it looks to secure financing to support its growth through a consortium of investors, which includes footballer Paul Pogba.

The Series B funding will raise around $50 million and is led by Wa’ed Ventures, the venture capital arm of Saudi Aramco.

Wahed expects to be worth around $300m post financing and the investment will support its current growth phase as it plans to launch an ethical online bank.

“For too long Muslims have had to compromise on quality of product and have had to pay a premium for the privilege,” Umer Suleman, Global Head of Risk and General Manager of Wahed UK, told Islam Channel.

“Wahed was set-up to provide genuine ethical and halal solutions to this growing market, the latest funding round has shown that Wahed’s mission is shared by industry leaders and values driven investors alike.”

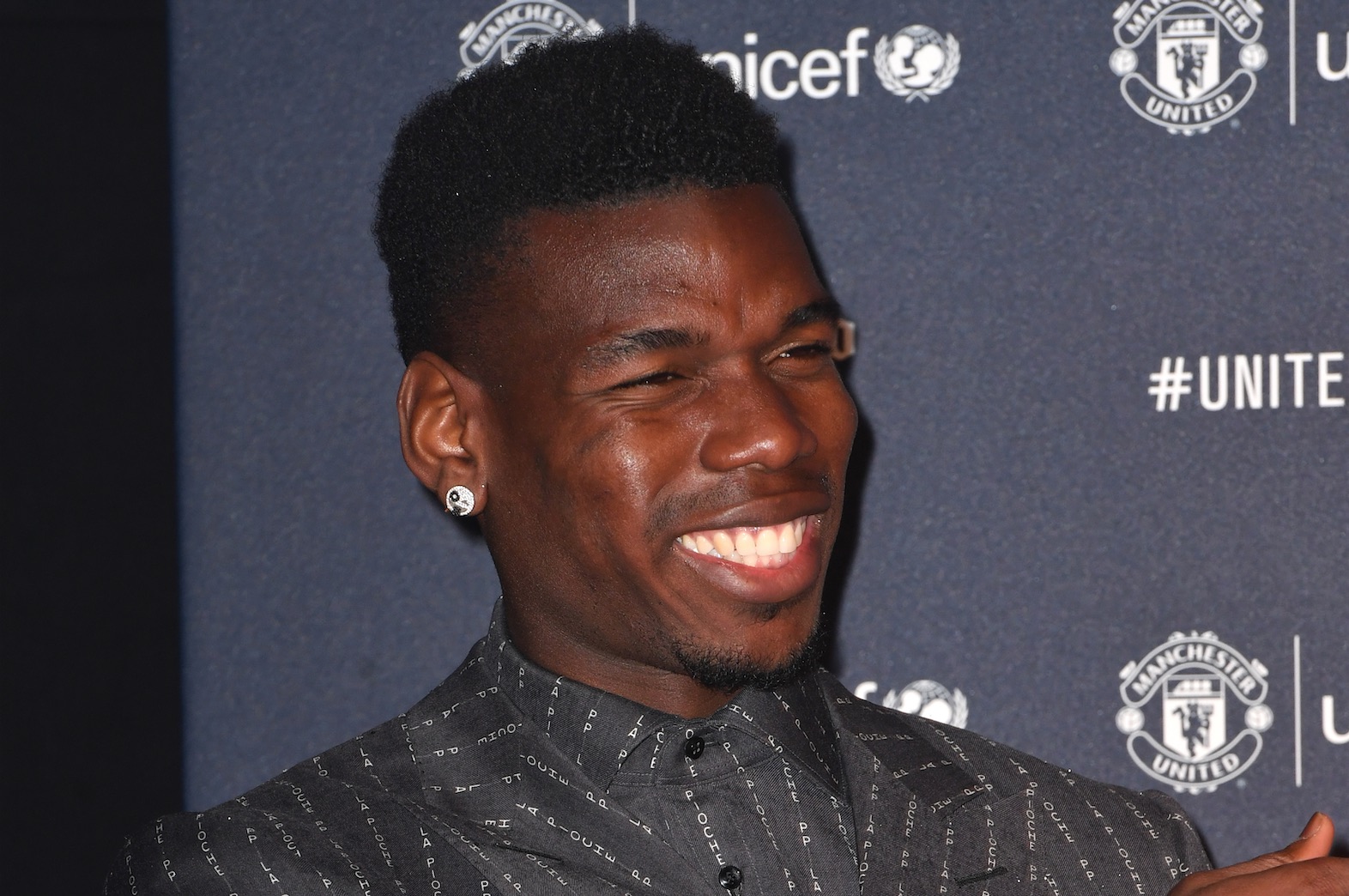

French footballer Paul Pogba is one of the investors in the global company. Pogba was unveiled as one of Wahed’s brand ambassadors, joining UFC Champion Khabib Nurmagomedov and his team of fighters.

Last week, he talked about why he joined Wahed and the importance of making halal investments.

Offering halal products and services

Wahed wants to offer products and services that let Muslims make investment choices without compromising on their faith. For example, it has an ethical board which ensures its investments do not deal with things like interest, gambling, alcohol, weaponry etc.

“The rapid popularization of fintech solutions and their influence in advancing financial literacy and inclusion worldwide have created the right urgency for fintech products that are both ethical and easily accessible for individual investors,” said Fahad Alidi, Managing Director at Wa’ed.

“Fintech leaders like Wahed acknowledge the role they play within such a globally crucial context, and it is their ambition to realize that vision that makes us proud to partner with the pioneering team as they work to unlock the digital potential of the financial industry,” he added.

The company began in 2015 and has over 300,000 customers in countries like the US, UK and Malaysia. It expects the demand for accessible fintech products that are halal, ethical and accessible will grow.

According to an August 2021 report by the Islamic Financial Services Board, the Islamic finance industry was estimated to be $2.70 trillion in 2020.

Earlier in the year, the group debuted the first Shariah-compliant and ESG-aware (environmental, social and corporate governance) investment fund on the Nasdaq.